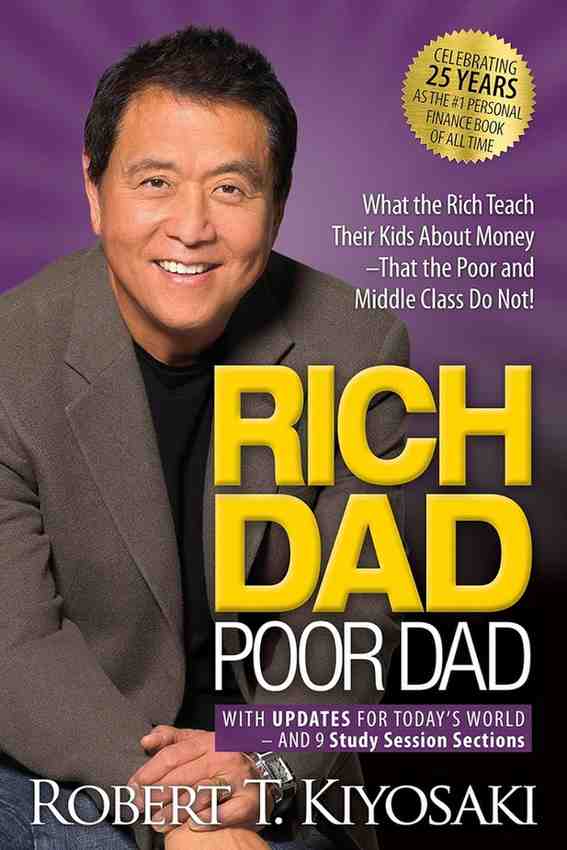

Rich Dad Poor Dad: Key Lessons for Financial Freedom (Without the Hype)

Robert Kiyosaki’s Rich Dad Poor Dad has sparked global conversations about wealth, mindset, and financial independence. But beyond the buzzwords, the book’s core principles challenge conventional wisdom about money. Here’s a breakdown of its most impactful lessons—without promotional fluff—and how they can reshape your financial future.

1. The Myth of the “Safe Job”

Kiyosaki contrasts his two father figures:

- Poor Dad (his biological father): A highly educated man who believed in job security, climbing the corporate ladder, and saving money. Despite a strong income, he struggled financially29.

- Rich Dad (his best friend’s father): A dropout who built businesses and invested in assets. He focused on making money work for him, not the other way around9.

Key Insight: Traditional education doesn’t teach financial literacy. The “safe job” mindset often leads to the rat race—working hard but never achieving true freedom410.

2. Assets vs. Liabilities: The Core Difference

Kiyosaki’s most famous lesson:

- Assets put money in your pocket (e.g., rental properties, stocks, businesses).

- Liabilities take money out (e.g., mortgages, car loans, credit card debt)47.

Common Misconception: Many think their home is an asset. In reality, unless it generates income, it’s a liability due to maintenance, taxes, and mortgage payments710.

3. The Power of Financial Education

Schools teach how to work for money, not how to manage it. Kiyosaki emphasizes:

- Self-education: Learn about taxes, investing, and market trends.

- Financial IQ: Understanding accounting, investing, and legal strategies protects and grows wealth49.

Example: The rich use corporations to reduce taxes (earn → spend → pay taxes), while employees pay taxes first (earn → pay taxes → spend)4.

4. Escape the “Bycoma” Trap

(Bycoma = buying unnecessary liabilities that drain wealth, like luxury cars or gadgets marketed as “investments.”)

Kiyosaki warns:

- The poor/middle class spend first, then save scraps.

- The rich invest first, then spend what’s left710.

Action Step: Audit your spending. Are you buying true assets or liabilities disguised as status symbols?

5. Take Calculated Risks

Fear keeps most people stuck. Kiyosaki’s advice:

- Start small (e.g., side hustles, low-cost investments).

- Fail fast and learn—mistakes are tuition for financial education910.

Real-World Lesson: Kiyosaki’s first business (a comic book library) taught him to spot opportunities others miss9.

Final Thought: Mindset Over Money

Rich Dad Poor Dad isn’t a get-rich-quick manual. It’s about shifting your relationship with money:

- Stop trading time for money.

- Build systems that generate passive income.

- Question societal norms (e.g., “debt is bad”—not if it’s used to buy assets)49.

Bycoma Alert: Avoid the trap of “looking rich” instead of being rich. True wealth grows silently through assets, not flashy purchases.

For deeper dives, explore Kiyosaki’s anecdotes on overcoming fear and the history of money39. No upsells—just the raw principles that matter.